If yes

If no

Discover Seller 365, Perfect for Growing Businesses - Learn more

Trusted by everyone

Chris Grant

12 years selling on Amazon

Chaz Leslie

9 years selling on Amazon, Walmart & eBay

Jim Cockrum

25 years online selling

Nikki Kirk

7 years selling on Amazon

James Percival

16 years selling on Amazon, Walmart, & eBay

Noah Mincis

8 years selling on Amazon, Walmart, & eBay

Chris Mangunza

8 years selling on Amazon

Cris Beam

4 years selling on Amazon

Your reality as a seller today and how we help you.

As a seller, you are getting squeezed from every direction. Rising fees, expensive software, and the need to pay for multiple services. That ends here. Threecolts is committed to give sellers everything they need to succeed at prices that don’t break the bank.

Because when sellers win, everyone wins.

Introducing Seller 365.

10 apps. 1 subscription.

$69/month.

The all-in-one seller software bundle. Source smarter, prep & ship quicker, win the sale, and manage your profitability.

What can you do with your Seller 365 bundle?

In short, everything!

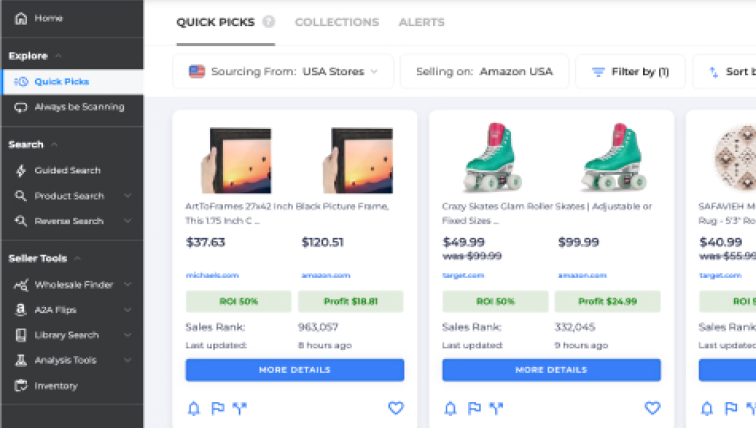

Find products that sell.

For online arbitrage, use:

Tactical Arbitrage

For book flipping, use:

ScoutIQ

For Amazon research, use:

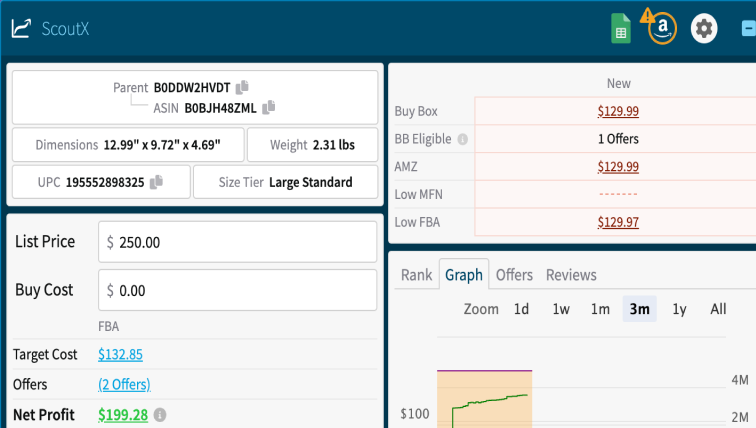

Scout X

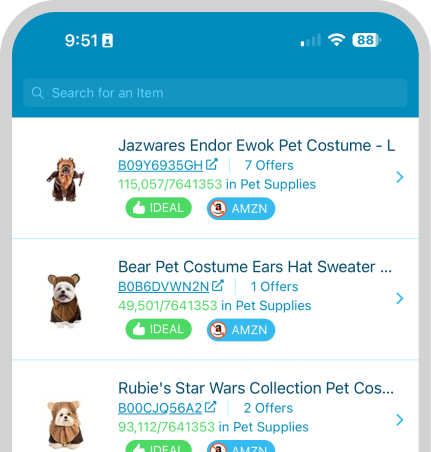

For retail arbitrage, use:

Scoutify

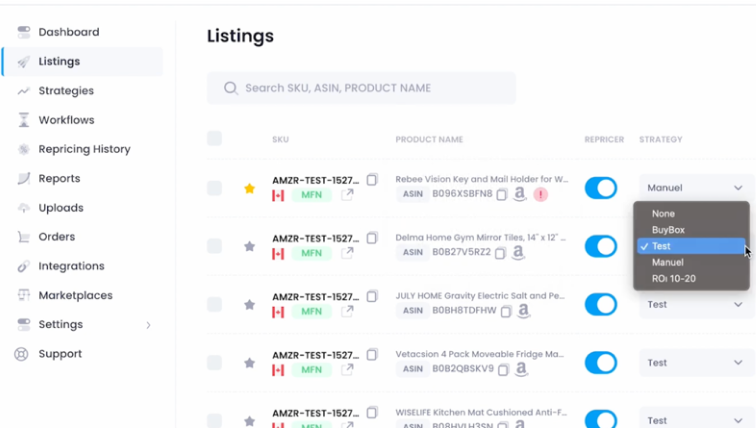

Win more sales.

For price automation, use:

SmartRepricer

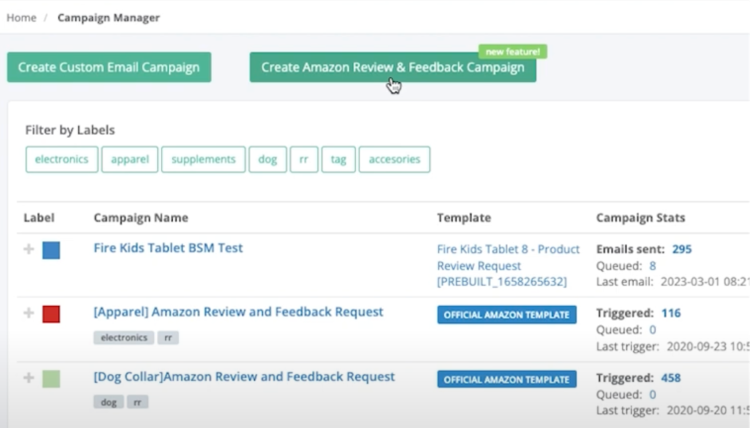

For reviews management, use:

FeedbackWhiz Emails

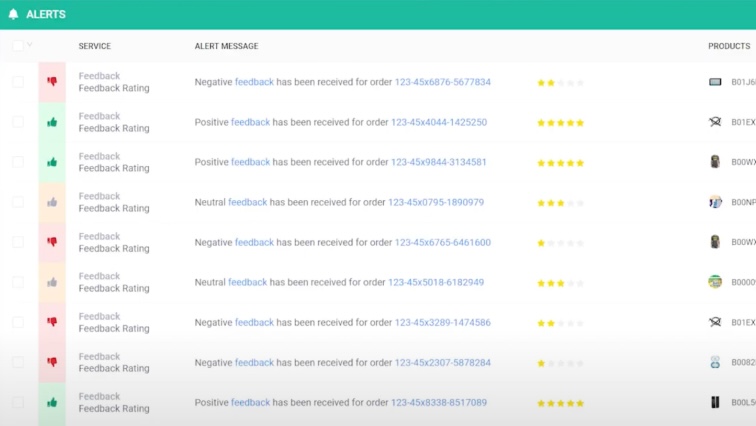

For monitoring listings, use:

FeedbackWhiz Alerts

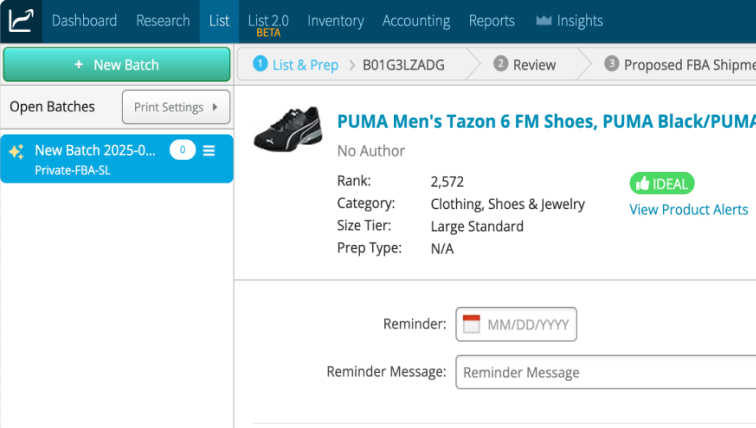

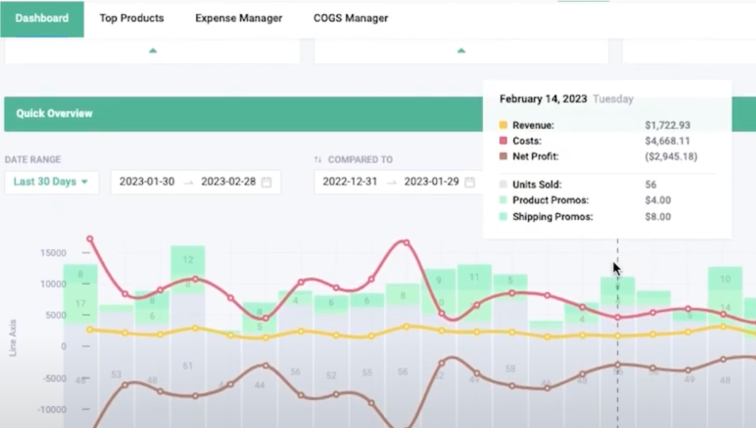

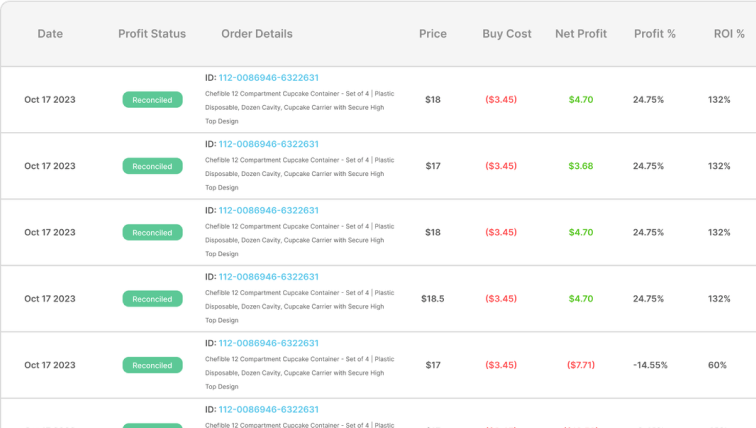

Manage your profit.

For multichannel reporting, use:

FeedbackWhiz Profits

For tax-ready accounting, use:

InventoryLab Accounting

Seller 365 is

for everyone

Resellers

Benefit from our comprehensive tools to streamline your sourcing, listing, selling, and profit management processes. Grow your business by identifying the most profitable products and optimizing your operations.

Private label

Use Seller 365 to build and scale your own brands.

With one subscription, you get all the tools you need to optimize pricing, manage inventory efficiently, and track sales and profits.

Prep centers

Streamline your fulfillment operations with Seller 365. Our platform offers features to optimize your workflows, manage inventory, and ensure timely order fulfillment.

Companies, brands, vendors, and D2C:

Explore our powerful solutions for your unique needs

Doing $1M+ in sales?

Maximize profits with

Margin Pro.

Margin Pro helps $1M+ sellers unlock hidden profits through automated marketplace reimbursements as well as supply chain and shipping cost optimization. Learn More

Unite multichannel

operations into one

powerful platform

Multichannel Pro unifies all your sales channels into one powerful platform, helping you lower your costs by 30% while delivering 4x faster customer service. Learn More

Chris Grant

Founder of Clear The Shelf Co-Creator of The OA Challenge, revROI, IP Alert, The Wholesale Challenge, and Amazon to Amazon Flips Challenge

At a glance

- 100,000+ items sold

- Multi-7-figures sold across marketplaces

- 4,000+ sellers coached

Actively selling on:

- Amazon

- Walmart

- Ebay

How Chris transformed ecommerce operations with Seller 365.

Chris says: Chris says: "Since discovering Tactical Arbitrage and InventoryLab, now part of the Seller 365 bundle, our Amazon business has completely transformed. Tactical Arbitrage is the perfect supplement to manual sourcing – it's agnostic to category or niche and uses data only to help you find profitable products to flip on Amazon. The tool has been invaluable in helping us find rabbit trails to new products and niches we've never thought of. Now that sellers can get access to the entire suite of tools from Threecolts inside of Seller365, I expect people will see profits multiply over the coming years."

Learn from

Chris.

YouTube: Clear The Shelf 500+ tutorials and reselling videos

Instagram: @cleartheshelf

Facebook: @cleartheshelf

See how other sellers are thriving with Threecolts

Get inspired by their journeys and see how our tools can help grow your business.

Chaz Leslie

Founder of Network Prep & The Sellers Network

At a glance

- $1,000,000+ in marketplace sales

- 40,000+ items sold successfully

- 9 years of Amazon, Walmart & eBay selling experience

- 140,000+ YouTube subscribers

- 3,000+ marketplace sellers coached

- 2,000,000+ items shipped through Network Prep

Actively selling on:

- Amazon

- Walmart

- Ebay

How Chaz transformed ecommerce operations with Seller 365

Chaz says: "The tools in Seller 365 have revolutionized my Amazon business. Tactical Arbitrage simplified the sourcing while InventoryLab allowed us to save hours per week with its smooth workflows and reporting!”

Learn from

Chaz.

YouTube: Side Hustle Network 500+ tutorials and reselling videos

Instagram: @TheSideHustleNetwork | @NetworkPrepCenter

Website: NetworkPrep.com

Join Chaz’s training sessions.

Discord Community: The Sellers Network Weekly live Zoom training sessions

Exclusive access to sourcing leads Step-by-step guides, and community challenges

See how other sellers are thriving with Threecolts

Get inspired by their journeys and see how our tools can help grow your business.

Jim Cockrum

Founder of Proven Amazon Course and The Proven Conference

At a glance

- Founder of The Proven Conference, the world’s longest-running Amazon seller event

- $50,000,000+ in online sales

- 25+ years of selling experience

- 1,000,000+ copies sold of his book, Silent Sales Machine

Actively selling on:

- Amazon

- Ebay

See how other sellers are thriving with Threecolts

Get inspired by their journeys and see how our tools can help grow your business.

James Percival

Founder and Lead Editor of The Selling Guys

At a glance

- $10,000,000+ in online sales

- 100,000+ marketplace sales

- 16 years of ecommerce experience

- 40,000+ Amazon seller community members

- Order fulfillment partner for Walmart, Tesco, and Staples

Actively selling on:

- Amazon

- eBay

- Walmart

Why James uses Threecolts.

James says: "I’ve spent 16 years selling through multiple channels and business models. At The Selling Guys, we’ve found Tactical Arbitrage to be a great tool for automating product sourcing, making Amazon online arbitrage a viable option”

The impact on my business operations:

- Tactical Arbitrage saves hours of manual work with scans of over 1,500+ stores.

- Gives detailed analysis with Product Search, Quick Picks, and Reverse Search.

- Can tailor results with custom filters, focusing on ROI, sales rank, and prep costs.

- Automates searches and alerts with unlimited scan minutes.

- Can access free training through Threecolts University.

Learn from

James.

Facebook: @TheSellingGuys

Twitter: @TheSellingGuys

LinkedIn: James Percival

Website: TheSellingGuys.com

See how other sellers are thriving with Threecolts

Get inspired by their journeys and see how our tools can help grow your business.

Noah Mincis

Multi-marketpalce seller Founder of Walmart Mastery

At a glance

- $16,000,000+ in marketplace sales

- 150,000+ sales across platforms

- 8 years of ecommerce experience

- 1,000+ Walmart sellers coached

Actively selling on:

- Amazon

- Walmart

- eBay

- Target

- Shopify

How Noah uses Threecolts to power his business.

Noah says: "I've used Threecolts' software extensively for both Amazon and Walmart, and it's been a game changer for my ecommerce business. The tools are intuitive and efficient, making inventory management and price optimization seamless. I highly recommend it to anyone looking to streamline their online selling operations and maximize profits. With FeedbackWhiz, I can effectively manage and improve my listings, ensuring I win the Buy Box while maintaining healthy profit margins.”

The impact on my business operations:

- Gain a competitive advantage by quickly finding profitable products and market trends.

- Win the Buy Box while maintaining healthy profit margins.

- Efficient inventory analysis and customer feedback management.

- Improve my customer service and brand reputation through automation.

Learn from

Noah.

YouTube: Noah Mincis

Join Noah’s training sessions.

Walmart seller training: Walmart Mastery Program

See how other sellers are thriving with Threecolts

Get inspired by their journeys and see how our tools can help grow your business.

Nikki Kirk

Founder of Your Selling Guide

At a glance

- $1,000,000+ in Amazon sales

- Coached over 8,000 sellers since 2019

- 7 years of Amazon experience

Previously sold on:

- Amazon

- Walmart

- eBay

- Poshmark

- Shopify

Why Nikki believes in Threecolts.

Nikki says: "As a dedicated retail arbitrage seller, I've relied on Threecolts' products for over three years. Scoutify's Buy List feature seamlessly integrates with InventoryLab, dramatically streamlining my FBA shipment process. The comprehensive inventory dashboard helps me track warehouse stock and forecast sales potential with ease. Combined with Tactical Arbitrage's versatile scanning capabilities, these tools have become essential to my Amazon business success, helping me discover unique product opportunities that others might miss.”

Learn from

Nikki.

See how other sellers are thriving with Threecolts

Get inspired by their journeys and see how our tools can help grow your business.